Creation date : 05/11/2024

As you know, in Luxembourg, taxes are deducted at source. That’s why many workers choose not to file a tax return, explains Frank Touvier, an AXA agent specialising in tax-deductible products:

"Many people have an aversion to paperwork. So, since the sums have already been paid, they prefer not to think about it," says the insurer.

If you are single and your net income is below €100,000 per year, filing a tax return isn’t compulsory in Luxembourg. So when is it a good idea to file a tax return? If you’ve taken out a few savings or insurance products, filing your tax return can save you a lot of money.

Which insurance premiums are deductible?

Article 111 of the Income Tax Act (ITA) governs the investment or provident expenses that are deductible from your tax base. They are listed below, and can be found in more detail here.

Let's take the example of Gregory. He arrived in Luxembourg 3 years ago and is the manager of a small team of developers in a start-up. He earns €40,000 net per year. Every year, a total of €4,649 is deducted from his salary in tax and he does not file a tax return.

However, Gregory puts a little more than €250 into a retirement savings plan each month, which he can deduct from his taxable income, in the same way as insurance for civil liability or his health insurance. Here are the details of the amounts that Gregory can deduct from his tax base:

- Business expenses (a lump sum representing his job-related expenses): € 540

- Civil liability portion of car and home insurance premiums (Art. 111): € 672

- Retirement savings: € 3,200

After deducting these savings and insurance limits, Gregory's new net taxable amount is now €35,588. As for the amount of tax, it has been reduced from €4,649 to €3,464, a saving of €1,185.

Not bad, eh? Now let's see how it works in practice.

How do you deduct your insurance premiums from your tax return?

- You can download the form from the Guichet.lu website (the form can only be downloaded in french or in german)

- Before completing your tax form, take the statement sent by your insurer at the beginning of the year, which gives a summary of the amounts to be deducted, whether for insurance or provident funds.

💡 It is only the amount of the insurance premium that relates to civil liability that can be deducted (not the total amount of the premium). So be sure to refer to the summary provided by your insurer.

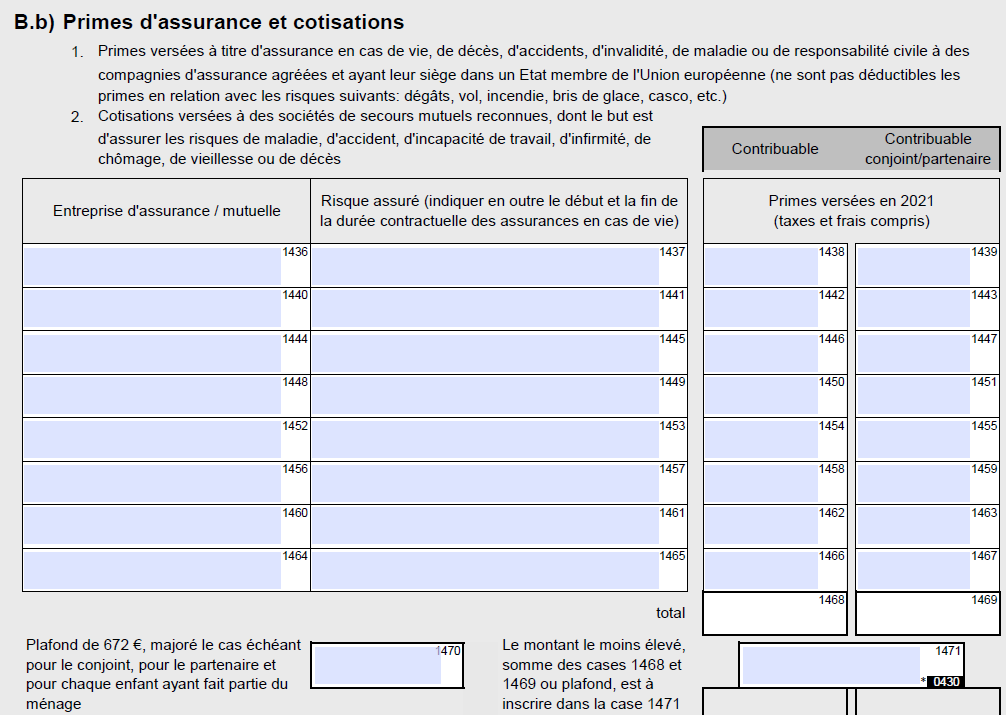

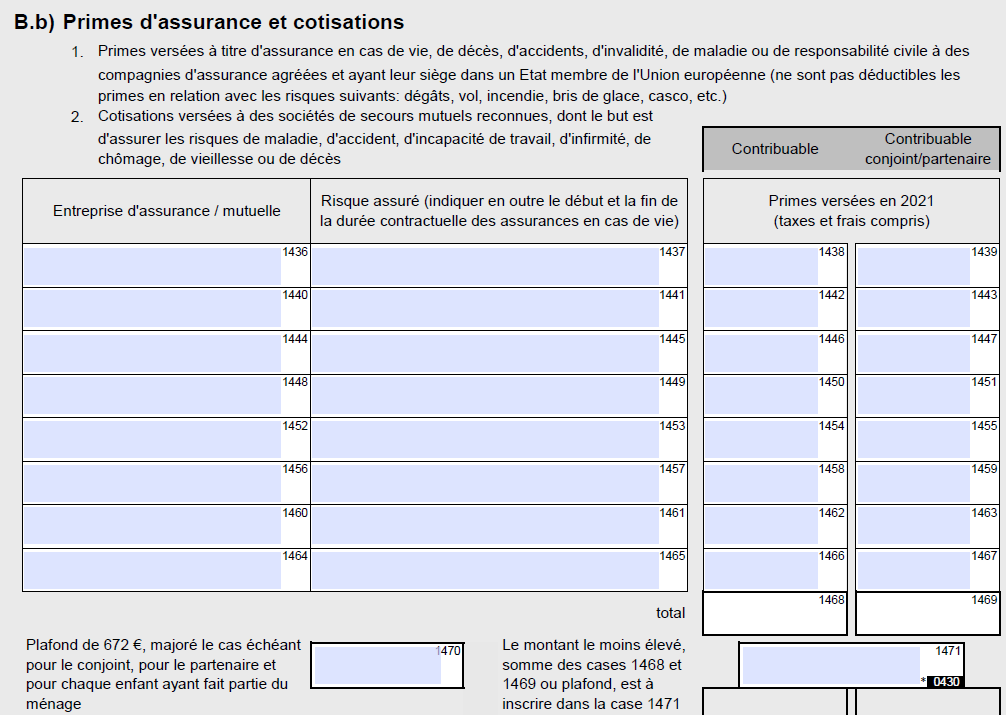

3. Complete the sections below relating to insurance premiums and provident contracts:

💡 The maximum deductible amount for insurance premiums (life, death, civil liability, etc.) is €672 per year (per household member, including children). € 3,200 for retirement savings.

4. Send the completed form to the tax authorities by post or directly online via MyGuichet.lu. You’ll find all the information here. You have until December 31 of the following year to complete your tax form.

5. Wait a few months for the tax authorities to get back to you, at the end of which you will be reimbursed by bank transfer.

Not so complicated, is it?

Still have a few questions? Don't hesitate to ask your insurance agent to find out how to deduct the amounts from your tax. For more comprehensive support with your tax return, you can hire an accounting firm to fill out your tax form for you and follow up with the tax authorities for a fee of about €250.

A big thank you to Frank Touvier, AXA Bettembourg branch, for his valuable advice in writing this article.

An advisor is available in every region of the Grand Duchy to offer you his services and his well-informed advice about insurance solutions : Do you need advice ?