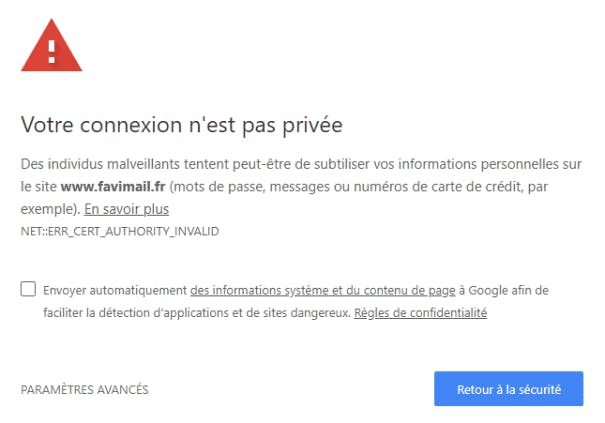

1 - Clicking on an e-mail link without checking the sender

It only takes a moment's inattention to disclose your personal data to complete strangers. Have you ever heard of e-mails supposedly sent by Nespresso, Netflix or Amazon?

Here are some examples:

mail from: contact@sauvelemonde.com

Dear Sir,

Your email has been selected to receive a Nespresso machine... answer the following questions to receive your gift.

-----

mail from: contact@zarratoolkit.com

Your AMAZON account has been restricted for security reasons, as we have noticed significant changes in your account activity. Please check your personal information to continue using your account without interruption.

-----

Check whether the domain hosting the sender's e-mail address is consistent with the company mentioned in the e-mail. If not, do not click and delete the email. These phishing techniques aim to recover your personal data which will be used to impersonate you and/or make purchases using your bank details.